Ferretti Group has reported its financial results for the first half of 2025, showing modest year-on-year growth in revenues and earnings, despite a backdrop of macroeconomic and geopolitical volatility.

Ferretti Group is a leading Italian luxury yacht builder with a diverse brand portfolio that includes Ferretti Yachts, Riva, Pershing, Itama, Custom Line, CRN, and Wally. Each brand targets a distinct segment of the market, from sleek sport yachts and flybridge cruisers to fully custom superyachts, positioning the Group at the forefront of both innovation and craftsmanship in the global yachting industry.

Commenting on the results is Chief Executive Officer Alberto Galassi: “In a macroeconomic environment marked by uncertainty, where the past quarter saw heightened global volatility and a slowdown in the luxury market, our Group has stood out for its resilience and continued growth, supported by strong cash generation and the distinctive nature of our business model and seven-brand portfolio.”

H1 2025 Financial Highlights

- Order Backlog: €1.446 billion (–3.3% YoY)

- Net Revenue from New Yachts: €620.4 million (+1.5% YoY)

- Adjusted EBITDA: €99.1 million (+2.5% YoY), margin at 16.0%

- Net Profit: €43.6 million (flat vs. H1 2024)

- Order Intake: €467.3 million (–9.2% YoY)

- Net Financial Position: €101.6 million in cash (+€47.0M vs. Q1)

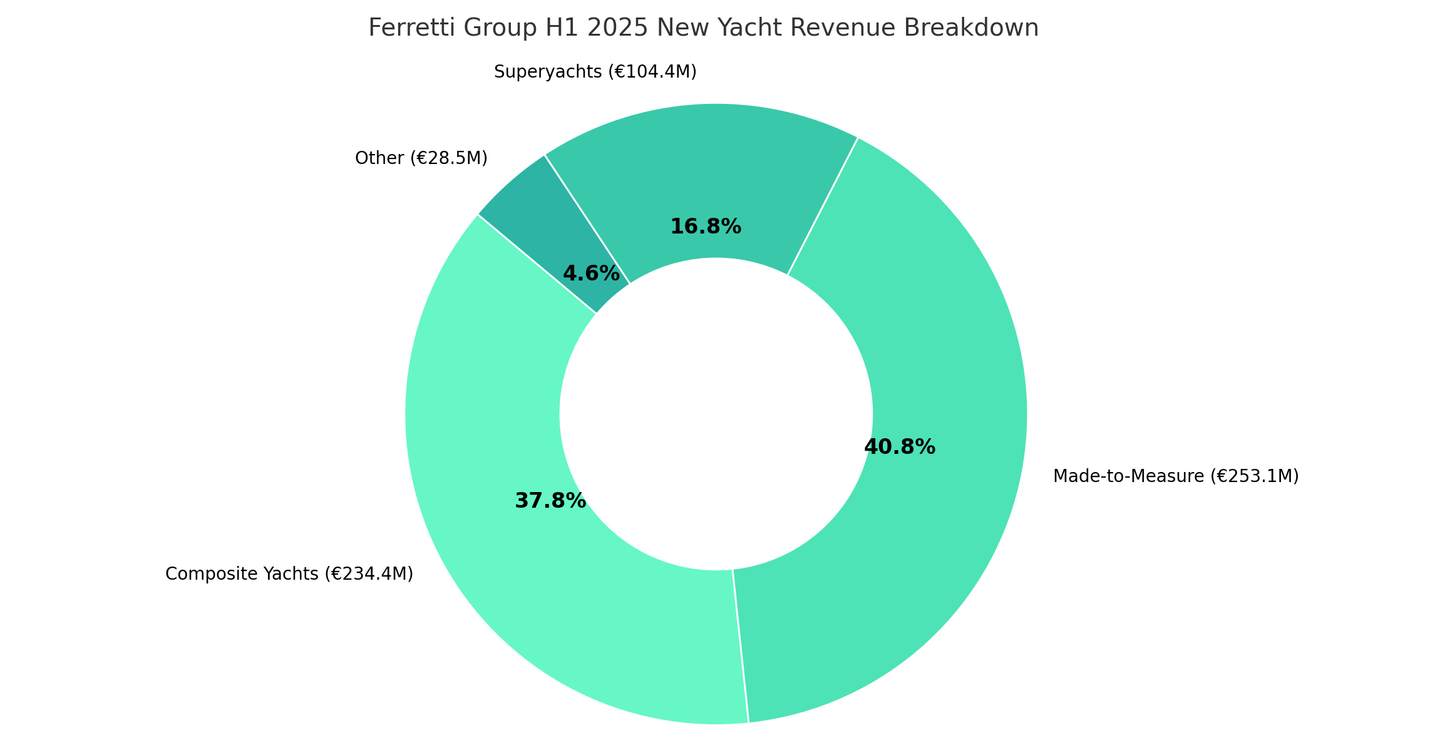

Segment Performance

Ferretti’s Made-to-Measure and Superyacht divisions led revenue and backlog growth, continuing the trend from Q1:

- Composite Yachts generated €234.4M in revenue (37.8% of total), down from €265M in H1 2024.

- Made-to-Measure Yachts rose to €253.1M (40.8%), up from €233.1M.

- Superyacht Revenue reached €104.4M (16.8%), climbing from €82.5M.

In the order backlog, Superyachts now represent 47.6% of the total — up sharply from 34.9% in 2024 — underscoring Ferretti’s strategic pivot toward larger, high-margin projects. The number of yachts delivered rose to 133, including 102 units in Q2 alone.

Analysis: Composite Segment Remains Pressured

While the over-24m composite segment saw signs of rebound in Q2, the overall revenue decline highlights continuing challenges:

- Weaker demand for sub-30m fiberglass yachts, particularly among first-time buyers

- Financing headwinds and higher sensitivity to macroeconomic volatility

- Growing tariff concerns in the U.S. — especially for popular models like the Riva 76 Bahamas, Ferretti 720, and Pershing 6X, which could fall under potential trade restrictions

- Shifting buyer preference toward semi-custom and alloy yachts, especially among ultra-high-net-worth clients

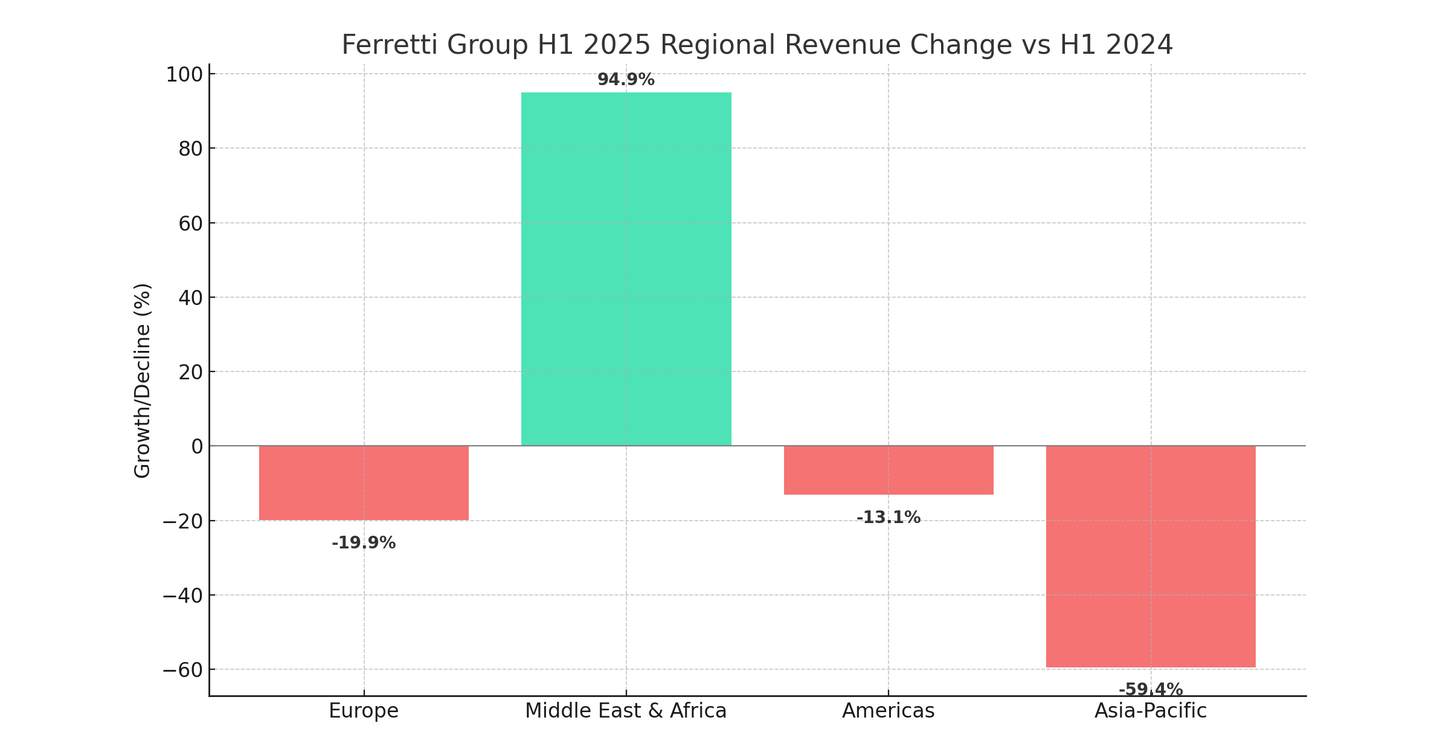

Regional Trends

- Europe: Remained the top market with €250.7M in revenue (40.4%), though down from €313M in H1 2024, likely reflecting delivery delays and softer macro sentiment.

- Middle East & Africa: Surged to €219.9M (35.4%), nearly doubling year-over-year, driven by sustained demand for large yachts in the Gulf region.

- Americas: Revenue fell to €140.1M (22.6%) from €161.3M, echoing the decline reported by U.S. dealer MarineMax. The softening reflects buyer caution and uncertainty over proposed U.S. tariffs on European yachts under 30 metres, which could impact brands like Riva, Pershing, and Ferretti Yachts in particular.

- Asia-Pacific: Continued to lag, generating just €9.7M (1.6%) compared to €23.9M last year.

This chart highlights regional shifts, particularly the sharp rebound in the Middle East & Africa, while Europe and the U.S. were impacted by economic headwinds and potential tariff concerns - mirroring trends seen in MarineMax's recent financial reports.

Strategic Outlook for H2 2025

Ferretti has reaffirmed its full-year guidance, forecasting new yacht revenues of €1.22 to €1.24 billion and an EBITDA margin improvement of 30–50 basis points.

The Group is expected to continue its strategic focus on:

- New superyacht and alloy-hull launches

- Expanding charter, brokerage, and after-sales services

- Enhancing environmental sustainability and innovation

While composite yachts face near-term headwinds, Ferretti’s expanding presence in the flagship and made-to-measure segments provides strong insulation against global uncertainty and tariff-related risks.

We will continue to launch new models in line with industry trends, while maintaining a consistent focus on operational efficiency and further strengthening our competitive advantage.

Global Uncertainty Exposes Market Divide in Yacht Industry

Taken together, the 2025 financial results from Ferretti Group, Sanlorenzo, and MarineMax underscore a bifurcated yacht market. Demand for larger, semi-custom and superyachts remains strong, driven by ultra-high-net-worth clients, long order backlogs, and brand differentiation. Both Ferretti and Sanlorenzo continue to pivot toward made-to-measure and superyacht segments where margins are high and customers are less price-sensitive.

At the same time, the entry-level and mid-range market faces mounting pressure from macroeconomic uncertainty, elevated financing costs, and potential U.S. tariffs on European yachts under 30 metres. Italian builders could be disproportionately affected as British brands not subject to the same trade restrictions may gain a competitive edge. MarineMax’s softer retail results highlight this dynamic, with signs of waning demand in the sub-30m European segment. Overall, the top end remains resilient but headwinds are clearly building across the lower tiers.

Looking for your dream luxury yacht? Explore our complete collection of new & used Ferretti yachts for sale worldwide, tracked in real-time by YachtBuyer MarketWatch. We scan the entire market to ensure access to all genuine listings, saving you time. Alternatively, you can view all other new & used yachts for sale.