The decision intensifies a proxy fight that has unfolded over recent weeks and underscores how strategic investor manoeuvres are steering the future of one of yachting’s flagship builders.

Who owns Ferretti today

Before diving into the latest developments, it helps to understand how Ferretti Group is currently owned.

Ferretti, the Italian yacht builder behind brands including Riva, Pershing, Ferretti Yachts, Custom Line, CRN Yachts and Wally, is publicly listed in Milan and Hong Kong. Its largest shareholder is China’s Weichai Group, which controls just under 40 percent of the company through its holding vehicle Ferretti International Holding.

The second-largest shareholder is KKCG, a Czech investment group, with a stake of around 14 to 15 percent.

The remaining shares are held by a mix of long-term strategic investors, including Italian and European shareholders, and the public market. In recent weeks, the shareholder base has broadened further with the arrival of Kuwaiti businessman Bader Nasser Al-Kharafi, who disclosed a 3 percent stake via his investment company BNK Holding.

This mix of Chinese, European and Middle Eastern capital now sits at the centre of a growing struggle over influence and control.

Weichai blocks KKCG’s move

That struggle intensified this week after Weichai Group formally rejected a partial takeover offer launched by KKCG, according to reporting from Bloomberg.

KKCG’s bid aimed to nearly double its stake in Ferretti, taking it close to the 30 percent level without triggering a full takeover under Italian and Hong Kong market rules. The move was widely seen as a way for KKCG to strengthen its voting power ahead of key shareholder meetings and push for changes at board level.

Weichai, however, made clear it does not intend to tender any shares into the offer and reaffirmed its position as Ferretti’s long-term controlling shareholder.

Why the board matters

The disagreement is not simply about share prices or valuation. At its core, it is a governance battle.

KKCG has been openly critical of Ferretti’s current board structure and is preparing to propose a shareholder vote to remove directors linked to Weichai. The Czech investor has said it is not seeking to replace senior management or take Ferretti private, but wants greater influence over how the company is governed.

Weichai, for its part, has accused Ferretti’s leadership of sidelining its representatives and has defended its right to maintain board influence in line with its shareholding.

The situation has been further complicated by past tensions, including disputes over strategic decisions, board dynamics and widely reported investigations that damaged trust between key shareholders.

Importantly, the current dispute is not directed at Ferretti’s management team, and chief executive Alberto Galassi remains firmly in place, although the outcome of the shareholder battle could influence how much freedom he has to steer the company’s long-term strategy.

New investors, higher stakes

The arrival of new shareholders, including Al-Kharafi’s BNK Holding, adds another layer of complexity. While his 3 percent stake does not give direct control, it introduces another international voice at a time when every percentage point of voting power matters.

With multiple large shareholders now jockeying for position, Ferretti’s next shareholder meeting is shaping up to be one of the most consequential in the company’s recent history.

What it means for yacht buyers

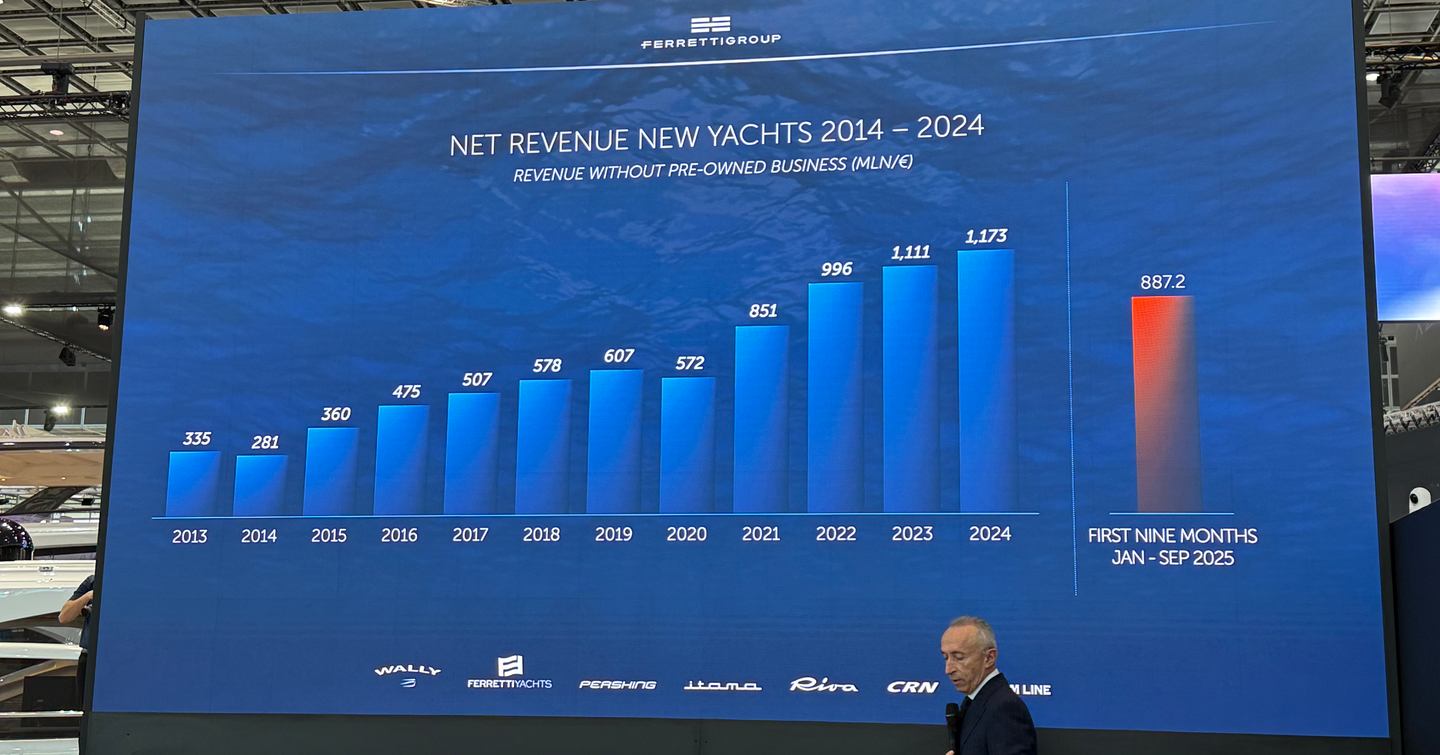

For customers and yacht owners, day-to-day operations remain unaffected. Ferretti continues to post strong order books and deliver yachts across its portfolio of brands, underpinned by one of the most extensive product strategies in the industry.

The group today offers the widest yacht collection across all its brands, having launched around 80 new models between 2016 and last year. That pace of development shows no sign of slowing. At a press conference during Boot Düsseldorf, Ferretti unveiled seven new models that will be presented during the 2026 season.

These include the new Ferretti 720, Pershing GTX90, Itama 70, Riva 56’ Rivale Super, Riva Caravelle, Custom Line Saetta 128’, and Custom Line Navetta 35. Updates were also confirmed for the wallywhy150, featuring a new interior layout, and for the wallywhy100, which gains a tender garage as part of its latest evolution.

Operationally and creatively, the group remains firmly focused on yacht building, design development and new launches across every size segment.

But behind the scenes, the question of who ultimately steers Ferretti’s long-term strategy remains unresolved as shareholders continue to wrestle for influence at board level.

For one of the world’s most iconic yacht builders, the fight is no longer just about building boats. It is about who holds the helm.

Interested in owning a Ferretti yacht? View all new and used Ferretti yachts for sale, tracked in real-time by YachtBuyer MarketWatch. We scan the entire market to ensure access to all genuine listings, saving you time. Alternatively, you can view all other yachts for sale.